Why Fiscal Policies Matter in Economic Stability

Are you wondering how governments keep economies afloat? The answer often lies in fiscal policy, a powerful tool that shapes our financial landscape. Understanding fiscal policy is crucial for anyone interested in how governments manage economies, influencing everything from job creation to inflation rates. This article explores the vital role fiscal policy plays in maintaining economic stability, addressing key questions, and providing insights into its mechanisms.

Key Takeaways:

- Fiscal policy involves government spending and taxation to influence the economy.

- It helps stabilize economies during recessions and manage inflation during periods of rapid growth.

- Different types of fiscal policy, such as expansionary and contractionary, have distinct effects.

- Effective fiscal policy requires careful planning and consideration of potential consequences.

Understanding the Basics of Fiscal Policy

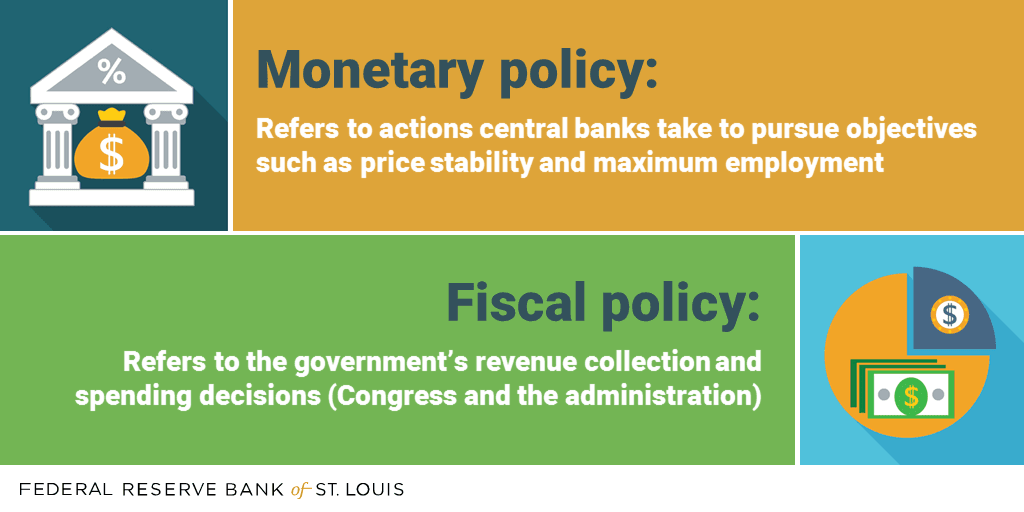

Fiscal policy is the use of government spending and taxation to influence a nation’s economy. It’s one of the primary tools governments use to steer the economy, alongside monetary policy, which is managed by central banks. Think of it as the government’s way of adjusting its budget to impact the overall economic climate. It can be used to stimulate growth during downturns or to cool down an overheating economy.

Government spending includes expenditures on infrastructure, education, healthcare, defense, and social welfare programs. Taxation, on the other hand, involves collecting revenue from individuals and businesses through various taxes, such as income tax, corporate tax, and sales tax. The balance between government spending and taxation determines whether the government runs a budget surplus (more revenue than spending) or a budget deficit (more spending than revenue).

When an economy is struggling, governments may implement expansionary fiscal policy. This involves increasing government spending or cutting taxes, or a combination of both. The goal is to boost demand and stimulate economic activity. For example, increasing spending on infrastructure projects creates jobs and boosts demand for materials, while tax cuts put more money in consumers’ pockets, encouraging them to spend more. The UK, also known as gb, might invest heavily in renewable energy projects during a recession to stimulate growth.

Conversely, when an economy is growing too quickly and inflation is rising, governments may implement contractionary fiscal policy. This involves decreasing government spending or raising taxes, or a combination of both. The goal is to reduce demand and cool down the economy. For example, reducing government spending on non-essential programs or raising income taxes can help curb inflation.

How Fiscal Policy Stabilizes the Economy

One of the main goals of fiscal policy is to stabilize the economy. Economies are rarely in perfect equilibrium. They go through cycles of expansion and contraction. During recessions, businesses cut back on investment and hiring, leading to job losses and reduced consumer spending. Fiscal policy can help cushion the blow of a recession by boosting demand and supporting employment.

Automatic stabilizers are built-in features of the fiscal policy that automatically kick in to help stabilize the economy. For example, unemployment benefits provide income support to people who have lost their jobs, helping them maintain their spending and preventing a sharp drop in demand. Similarly, progressive income taxes, where higher earners pay a larger percentage of their income in taxes, automatically reduce disposable income during booms and increase it during recessions, helping to moderate economic fluctuations.

Discretionary fiscal policy involves deliberate decisions by the government to change spending or taxes in response to specific economic conditions. For example, during the financial crisis of 2008, many governments implemented stimulus packages that included increased spending on infrastructure, tax cuts, and aid to struggling industries. These measures were designed to boost demand and prevent a deeper recession.

Effective fiscal policy requires careful planning and coordination. Governments must consider the potential impact of their policies on different sectors of the economy and on different groups of people. They must also be aware of the potential for unintended consequences, such as inflation or increased debt.

The Impact of Fiscal Policy on Economic Growth

Fiscal policy can also play a significant role in promoting long-term economic growth. By investing in education, infrastructure, and research and development, governments can increase the economy’s productive capacity and foster innovation. For example, investments in education can improve the skills and knowledge of the workforce, making them more productive. Investments in infrastructure, such as roads, bridges, and airports, can reduce transportation costs and improve the efficiency of businesses. Investments in research and development can lead to new technologies and products that drive economic growth.

However, fiscal policy can also have negative effects on economic growth if it is not managed properly. High levels of government debt can crowd out private investment, as governments compete with businesses for funds. High taxes can discourage work effort and investment. Therefore, it is important for governments to strike a balance between using fiscal policy to stimulate growth and maintaining fiscal sustainability.

For example, countries like the gb have invested in green technologies, spurred by government incentives and tax breaks. Such policies aim not only to reduce carbon emissions but also to foster growth in the green energy sector, creating new jobs and industries.

Challenges and Considerations in Implementing Fiscal Policy

Implementing fiscal policy effectively is not always easy. There are several challenges and considerations that governments must take into account. One challenge is the time lag between when a fiscal policy is implemented and when its effects are felt. It can take several months or even years for a change in government spending or taxes to fully impact the economy. This makes it difficult for governments to fine-tune their policies to respond to changing economic conditions.

Another challenge is the potential for political interference. Fiscal policy decisions are often politically sensitive, as they can affect different groups of people in different ways. This can lead to governments making decisions that are not economically sound but are politically popular.

Finally, governments must be aware of the potential for unintended consequences. For example, a tax cut designed to stimulate the economy may end up benefiting mostly wealthy individuals, leading to increased income inequality. Or, increased government spending may lead to inflation if the economy is already operating at full capacity.

Therefore, effective fiscal policy requires careful planning, coordination, and a willingness to make difficult decisions. Governments must be transparent about their goals and policies and be accountable for the results. They must also be willing to learn from their mistakes and adjust their policies as needed.